Successfully managing the retirement assets of insured persons is the main mission of any pension fund.

Yields make it possible to build up the reserves required by law, to involve the active members by paying them generous interests (at least the minimum interest rate in force), to partially finance retirement pensions and finally to ensure the growth and solid development of the pension fund.

For active members, it is crucial to be able to receive the best possible interest over the years so that they can accumulate the highest possible capital.

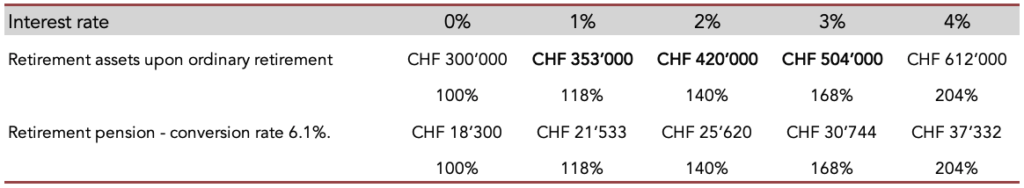

How significant the effect of compound interest is can be seen in the table below.

The calculation is based on a constant AHV salary of CHF 85,000, coordination deduction of CHF 25,000, savings credit scale 7/10/15/18%.

Over the 40 years of membership, the employee saves a capital of CHF 300,000, of which at least 50% has been paid in by the employer.

Since the introduction of the compulsory BVG and until 2002, the law defined the minimum interest rate as 4%.

Since then, the financial markets have been facing more difficult conditions and as a result, the revised BVG-Law assigned the Federal Council the task of defining, year by year, the minimum interest rate that pension funds are required to pay.

As of 2017, the minimum interest rate is set at 1%.

Avanea was founded with the aim of offering its clients a selection of different investment strategies that take different approaches to investment philosophy.