03 Feb Newsflash 21.9.20

Newsflash 21.09.20

Investment model 20

Since 2016, Avanea has been running a conservative investment model with a moderate equity share of 20% in parallel to the investment model 30. The basic idea was to give companies the choice between a balanced and a conservative investment strategy.

Unfortunately, the interest in investment model 20 was very modest, especially due to the excellent results in investment model 30. The parallel management of two different investment models each requires its own accounting, liquidity planning, coverage ratio calculation, etc., and ultimately the two models still have to be presented in consolidated form.

Based on the findings described above, the Foundation Board decided at its last meeting on 27 August 2020 to discontinue investment model 20 at the end of the year. The affiliated companies will be given the opportunity to transfer to the successful investment model 30 as of 1 January 2021. Since the coverage ratios of the two investment models are practically at the same level, a changeover can be implemented without any problems and without any major effort.

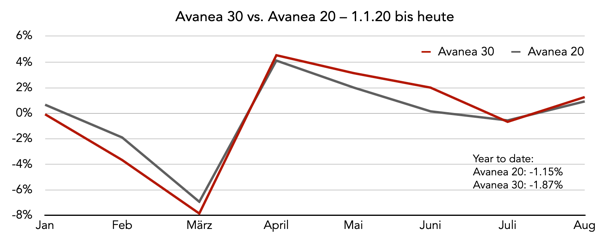

Performance in Covid times

We are regularly contacted by affiliation partners or their representatives regarding current performance. The pension landscape and the financial markets have so far survived the Covid 19 virus unscathed.

Annual Report 2019

We are pleased to enclose the 2019 Annual Report of the Avanea Pension Fund.

The year 2019 will certainly be remembered fondly for some time to come, especially the record result on the investment side, where we were able to achieve a performance of 18.2% in investment model 30. The Foundation’s growth was also impressive once again. The number of affiliations increased by 65%, the number of insured persons by as much as 90% and the assets under management by 86%.

For further figures and remarks, please refer to the enclosed annual report.

Click the following button to open the pdf file (document in German).